Budgeting is the foundation of effective financial management. Whether you’re saving for a significant life event, tackling debt, or simply trying to manage your day-to-day expenses, a well-thought-out budget is essential. GoMyFinance.com offers a practical, user-friendly platform to help you establish a budget that aligns with your goals, tracks your spending, and keeps you accountable. Let’s walk through how you can use GoMyFinance.com to create a realistic and manageable budget for yourself.

Understanding the Basics of Budgeting

The purpose of a budget is simple: it’s a financial tool that helps you allocate your income across different categories of spending. Without a budget, it’s easy to overspend, miss savings opportunities, or accumulate unnecessary debt. The key is to balance your essential costs with your wants and long-term goals.

At its core, budgeting allows you to:

- Track your income and expenses

- Prioritize savings and debt repayment

- Ensure you have enough funds for both your needs and desires

One of the main reasons people struggle with budgeting is they don’t account for the small, everyday expenses that quietly add up over time. GoMyFinance.com helps tackle this issue by offering a structured platform that categorizes your expenses, making it easier to see where your money is going.

Key Steps in Building Your Budget with GoMyFinance.com

- Define Your Income and Expenses

The first step is to understand how much money you bring in each month. For example, if your monthly income is $3,000, GoMyFinance.com allows you to allocate that money into various spending categories. This ensures that your income is being distributed in a way that helps you stay financially secure. - Categorize Your Expenses

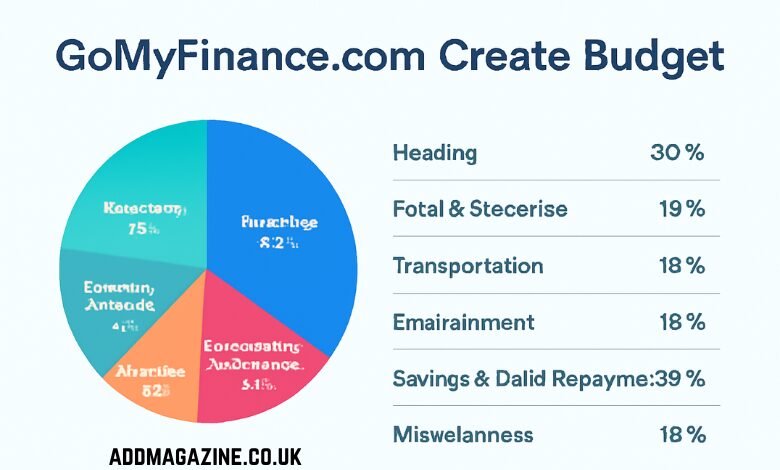

GoMyFinance.com helps you organize your spending into categories, which makes it easier to track where your money is going. You can create custom categories based on your specific needs, but here’s a simple example of how you might categorize your $3,000 monthly income:- Housing (30%): $900

Housing costs typically include rent or mortgage payments, property taxes, and home insurance. By allocating 30% of your income to this category, you ensure that your basic living expenses are covered without exceeding your financial limits. - Food & Groceries (15%): $450

Food is an essential expense, and budgeting for groceries, dining out, and takeout helps keep this category manageable. The 15% allocation allows for a comfortable amount to feed yourself and your family while still having room for savings. - Transportation (10%): $300

Whether you’re paying for car payments, gas, public transportation, or rideshare services, transportation costs can add up. A 10% allocation helps you manage these costs without stretching your finances too thin. - Entertainment (10%): $300

Everyone needs to unwind, and entertainment expenses like streaming services, dining out, or hobbies fall under this category. Setting aside 10% ensures you can enjoy your downtime without feeling guilty about overspending. - Savings & Debt Repayment (20%): $600

A vital part of any budget is ensuring you are saving for the future and paying down any outstanding debt. Allocating 20% of your income to savings and debt repayment ensures you’re building an emergency fund or contributing to your retirement while working towards becoming debt-free. - Miscellaneous (15%): $450

This category covers all the smaller, unexpected expenses that don’t fit into the other categories—things like gifts, medical bills, personal care, and other random costs. Having a buffer for miscellaneous expenses keeps your budget flexible and prevents surprise costs from derailing your financial plan.

- Housing (30%): $900

- Track Your Spending in Real-Time

Once your budget categories are set up, GoMyFinance.com automatically tracks your spending in each category by linking your bank accounts or credit cards. It keeps a close eye on how much you’re spending in real-time and notifies you when you’re getting close to your budget limits. This makes it much easier to avoid overspending and ensures that you remain on track throughout the month. - Use Visual Tools to Stay Motivated

GoMyFinance.com takes a unique approach to keep you engaged and motivated in your budgeting journey by providing charts, graphs, and visual breakdowns. These tools help you clearly see your spending patterns and track your progress in each category. For example, if you’ve set a savings goal of $600 per month, GoMyFinance.com’s goal tracker will show you how close you are to reaching that target. Seeing your progress in real-time not only helps keep you focused but also encourages you to stay disciplined with your spending. - Adjust Your Budget as Needed

Budgets are not static; life changes, and so do your financial circumstances. Whether you get a raise, face unexpected medical bills, or have a new expense, it’s important to regularly review your budget and make adjustments as necessary. GoMyFinance.com encourages monthly reviews, where you can compare your actual spending to your planned budget. This allows you to make informed decisions about where to cut back or where you might need to increase your allocation. For example, if your entertainment expenses are consistently higher than expected, you can adjust your budget to allocate more funds for this category.

Why GoMyFinance.com is an Effective Budgeting Tool

GoMyFinance.com stands out for several reasons. Firstly, it automates much of the process by linking to your financial accounts and categorizing transactions for you. This reduces the time and effort needed to manually log each expense and provides you with a clear, real-time picture of your finances.

Secondly, the platform’s goal-setting feature allows you to stay focused on specific financial objectives. Whether you’re saving for a vacation, a new gadget, or building an emergency fund, GoMyFinance.com provides a visual representation of your progress, which helps keep you motivated to continue saving and budgeting.

Lastly, GoMyFinance.com’s mobile notifications and alerts keep you on track, even when you’re on the go. If you’re nearing your spending limits in a certain category, you’ll receive an alert, so you can make adjustments immediately. This proactive approach helps prevent any financial surprises at the end of the month.

Common Budgeting Mistakes and How to Avoid Them

Budgeting can be a challenge, especially when it’s easy to overlook small expenses. Here are a few common mistakes people make and how GoMyFinance.com can help avoid them:

- Overestimating Income

Budgeting based on a higher income than you actually receive can lead to overspending. GoMyFinance.com’s accurate income tracking ensures that you’re budgeting based on your actual earnings rather than inflated projections. - Ignoring Small Expenses

It’s easy to forget about those small, daily expenses like coffee, snacks, or delivery charges. By categorizing every expense and tracking them regularly, GoMyFinance.com helps ensure you stay on top of even the smallest costs. - Not Adjusting Your Budget Regularly

Life changes, and so should your budget. GoMyFinance.com encourages regular reviews to ensure your financial plan is always aligned with your current situation. - Underestimating Irregular Expenses

People often forget to budget for non-monthly expenses, such as holiday gifts, vehicle maintenance, or subscriptions. GoMyFinance.com’s “Miscellaneous” category provides a buffer for these irregular costs.

The Role of Goal Setting in Budgeting

A budget is most effective when paired with concrete financial goals. GoMyFinance.com encourages you to set specific savings goals, such as an emergency fund, debt repayment, or a vacation fund. When you have a clear target in mind, it becomes much easier to prioritize your spending.

For example, if you’re saving for a new car, GoMyFinance.com allows you to set a target amount and track your progress each month. This goal-oriented approach ensures that your budget isn’t just about managing expenses but also about achieving something meaningful.

Conclusion

A well-managed budget is the key to financial peace of mind. GoMyFinance.com provides a simple and effective way to manage your money by breaking down your income, expenses, savings, and debt repayment into clear, manageable categories. By using GoMyFinance.com, you gain access to powerful budgeting tools that help you track your spending, set financial goals, and stay on top of your finances.

With its user-friendly interface, automatic expense tracking, and goal-setting features, GoMyFinance.com takes the stress out of budgeting. Whether you’re trying to save for a big purchase, reduce debt, or simply gain control over your day-to-day spending, GoMyFinance.com is an invaluable tool for financial success.